Liquid Staking on Solana

Navigating through Liquid staking landscape of Solana

Why this article?

Liquid staking has emerged as the biggest Defi category in terms of the Total value of Locked assets. If we talk in terms of numbers, According to Defillama Liquid staking as a category of protocols currently holds $40.489 B worth of assets and is the largest category in Defi or probably the largest category in web3 excluding chains.

But the question that probably everyone is asking is that even being young as a narrative how Liquid Staking can capture such a huge market??

…and the answer is simple, use case. yes, you read it right!!! Use case or utility is something that every protocol or Dapp has been trying to establish for a long now. Liquid staking is a prime example of how much value the industry can get if the right products are built having the right use cases.

so this article is about Liquid staking?? Um, yes and no. we will discuss liquid staking but focus majorly on Solana. There has been lots of research done and content written on Ethereum staking(Contact me if you want to read one, and I will send that your way). For the next 10-15 minutes I will take you to the data compact and educational ride of Liquid staking on Solana. We will also look at one of the finest protocols in the category: SolBlaze in detail.

We will again meet at the end where I will share my opinion to you casually. but till then i will try to keep this article more professional. So let’s get started.

Tale of Staking

What is Staking? - Brief Background and history

Staking is the process of locking a certain amount of tokens to become eligible to validate blocks in Proof of Stake Blockchains. It is essential to note that staking does not apply to Bitcoin, which operates on a Proof of Work mechanism. Similarly, Ethereum only adopted staking when it transitioned to Proof of Stake.

When tokens are staked, they play a critical role in the network's consensus mechanism. Validators receive rewards for their contributions to network operations, while individuals engaging in malicious activities may face penalties such as having their staked tokens slashed. This system is designed to maintain the security of the network, ensuring its integrity and reliability over time.

Becoming a validator requires specific hardware and resources to run a node, making it inaccessible to everyone. However, anyone can still participate in the consensus mechanism through staking, even with smaller token amounts. This inclusive approach allows for broader participation in network maintenance and governance, fostering a decentralized and robust ecosystem.

Types of Staking

Becoming a Validator to Stake:

o engage in staking your coins as a validator, you need to be tech-savvy in the world of crypto and blockchains. This method requires having a reliable computer online 24/7 and a substantial amount of cryptocurrency to get started. For instance, on Ethereum, you would need 32 ETH to participate. On Solana, the specific amount of SOL required to become a validator is not explicitly mentioned in the provided sources

Validators have the crucial role of creating blocks and verifying their correctness. However, it's important to be cautious because breaking the rules can result in being slashed, which means losing a portion of your stake.

Delegate your Stake:

If setting up a node seems too complex, you have the option to delegate your stake to a reliable validator. By entrusting them with your funds, you can earn rewards, albeit with a small fee deducted.

If you have 32 ETH but prefer not to run a node yourself, you can have someone else take care of the technical details for you.

Pooled Staking:

If you're pressed for time or resources, pooled staking could be the solution for you. With pooled staking, you entrust your tokens to a pool operator who manages them on your behalf.

Teaming up with others can enhance your chances of earning rewards, and many pools provide flexible options to choose from.

Liquid Staking:

As staking becomes more popular, platforms such as Lido, Rocket Pool, and Stakewise have introduced a solution for individuals concerned about locking up their coins: liquid staking.

You can lock up your funds to earn rewards while still being able to access them.

When you stake ETH with Lido, you receive stETH tokens in return, which are equivalent to your initial stake. These tokens function just like regular ETH, and you receive real-time updates on your staking rewards.

Issues with Staking?

Conventional staking processes often involve intricate software and hardware setups, sometimes requiring users to lock up assets for extended periods. For instance, the Ethereum community had to wait 862 days for the Shanghai/Capella upgrade before accessing their locked funds.

To run validator software on Ethereum, a minimum of 32 ETH is required for staking. This threshold posed a significant barrier for many individuals looking to join the staking process.

When you stake your funds with a validator, there is always a risk of losing them if the validator acts improperly.

When you stake a token, you cannot use it for any other DeFi activities.

With all these flaws and inefficiencies mentioned in a blog post, the first liquid staking protocol was launched in Dec 2020 named LIDO.

Liquid Staking

What is liquid Staking?

Liquid staking, also known as "soft staking," is a process where users lock up their funds to earn rewards while still retaining access to their assets. In contrast to traditional proof-of-stake (PoS) staking that locks funds within a protocol, liquid staking allows funds to remain accessible in an escrow. Users deposit their funds into a DeFi application escrow account and, in return, receive a tokenized version of their assets.

Liquid staking is a modern approach that enhances traditional staking methods by offering increased flexibility and accessibility to users. Unlike conventional staking, where tokens are locked up for a specific period, liquid staking allows users to unstake their tokens immediately, providing efficient capital allocation and the ability to engage in other financial activities without the need to unstake their tokens. This innovation not only promotes liquidity for staked assets but also boosts the composability of DeFi protocols, enabling users to utilize their liquid tokens in various DeFi platforms, thereby enhancing engagement and potential returns. Liquid staking also presents the opportunity for higher rewards compared to traditional staking, as users can earn additional rewards on top of their original staking rewards by utilizing liquid tokens in multiple staking platforms

Staking v/s Liquid staking

Liquid staking protocols offer several advantages for validator operators compared to traditional staking. Some of the key advantages include:

Increased Flexibility and Liquidity: Liquid staking allows users to stake tokens in Proof of Stake (PoS) networks, enabling them to earn rewards while keeping their tokens liquid and accessible. This means stakers can maintain flexibility and liquidity without the need to unstake their tokens. By utilizing liquid staking, individuals can efficiently allocate capital and enhance the utility of their assets. Stakers can access liquidity without locking up their tokens, thus optimizing their capital allocation and maximizing utility.

Regular Earning of Staking Rewards: Liquid staking provides stakers with the opportunity to receive regular yield rewards, much like traditional staking. Moreover, stakers have the chance to obtain a representative token enabling participation in the DeFi market.

Maximizing Yield Potential: Liquid staking offers a way to optimize yield potential by enabling staked assets to remain liquid, enabling stakers to engage in staking rewards without compromising liquidity.

Reduced Economic Barrier for Individual Validators: Liquid staking protocols have the potential to lower the economic hurdle for individual validators. They enable staking with smaller token amounts, thus enhancing accessibility to staking.

Components of Liquid Staking

LST: Liquid staking tokens are the tokens generated when a native token is staked via a liquid staking protocol. Every liquid staking protocol has its own token that is pegged to the native token. For example: SolBlaze is a liquid staking protocol on Solana that has bSol as a liquid staking protocol.

Liquid Staking protocol: With Liquid staking protocol you can stake your assets, in return you get a liquid staking token that can be used in the

Liquid staking Defi Protocols: Liquid staking tokens can be used in Defi protocols for lending borrowing, providing liquidity and many more things.

Now let’s look at liquid staking and its growth in the Solana Ecosystem

Liquid Staking on Solana.

Liquid staking protocols in the Solana Ecosystem.

1. Marinade: Established in March 2021, Marinade emerged as Solana's inaugural liquid staking solution. It provides two primary staking choices: liquid staking and native staking.

Liquid staking: In Marinade, you invest your SOL into a stake pool and in return, you receive mSOL. As your staked SOL generates rewards (MNDE tokens) and yield, which are then directly added to the value of mSOL, you have the flexibility to utilize your mSOL as collateral across different DeFi platforms like Solend, marginfi, or Mango.

Native staking: Marinade Native is an alternative to liquid staking that allows users to benefit from an automated delegation strategy without using any smart contract. For more on how Marinade Native differs from liquid staking, read Marinade's guide.

Marginfi: Marginfi provides a range of services, with its key offerings being borrowing/lending and its liquid staking token, known as "LST."

Through Marginfi Stake, users have the option to deposit SOL or convert their staked SOL to acquire Marginfi’s LST.

By doing so, you can take advantage of the following benefits:

No fees

0% commission

A higher yield (at times)

Jito sol: let's talk about something crucial in the world of validating transactions: maximizing extractable value, or MEV.

MEV basically refers to the maximum potential value a validator can gain by arranging, including, or excluding transactions during the block production process. It's like tapping into the full potential of what's happening in each block. This includes both transaction fees and any extra profit that comes from controlling the order of transactions.

Now, where does Jito come into play?

Well, JitoSOL stake pool is all about delegating exclusively to validators using the Jito-Solana validator client. This setup helps to minimize the downsides of MEV, such as spam trades and transaction failures, while maximizing its benefits, like boosting network efficiency and increasing profits.

So, when you stake with Jito, you receive JitoSOL LST tokens that earn you rewards over time. These rewards come from both staking and MEV. Here's the cool part: a portion of the MEV collected by Jito validators is shared directly with stakers, creating a positive cycle that benefits everyone involved in the Solana ecosystem.

SolBlaze: At its core, the Blaze stake pool works the same as the ones from Marinade and Jito mentioned above.

With that said, there are some differences:

Blaze has the largest validator set of any Solana stake pool (200+ validators).

Blaze leverages the official stake pool smart contracts from Solana Labs, which is heavily audited.

Blaze pioneered the Custom Liquid Staking protocol, which allows you to liquid stakes to specific validators or groups of validators.

When staking with Blaze, you don't receive mSOL or JitoSOL, but yield-bearing bSOL and the corresponding rewards.

Growth of the liquid staking ecosystem on Solana over time

Right now, one of the most talked-about trends in the markets is liquid staking. As of the time of writing this article, according to The Defilama, liquid staking protocols such as Marinade Finance, Jito, SolBlaze, and Marginfi have seen a whopping $2 billion in staked Solana (SOL) tokens. This marks a significant increase from the initial approximately $98 million staked at the beginning of 2023. Presently, these protocols make up one-third of the total value locked within the network, which is estimated to be around $6.226 billion.

The total Value Locked in Liquid Staking protocols on Solana has surged by a Staggering 2000% compared to the Start of 2023. That’s the massive growth!!!

5% vs 45%

Let's make a quick and straightforward comparison. Currently, on Solana, approximately 5% of staked SOL tokens are utilizing liquid staking. This means that out of every 100 SOL tokens staked on Solana, only 5% are done through liquid staking. This percentage appears notably lower when compared to Ethereum, where the figure stands around 45%.

While there are many reasons behind less adoption of Liquid Staking on Solana. Some of them are:

1. Maturity of the Ecosystem: Liquid staking on Solana emerged more recently compared to Ethereum. Marinade, the inaugural liquid staking protocol for Solana, was introduced in August 2021, whereas Lido, the leading liquid staking provider for Ethereum, began in 2020. This early advantage allowed Lido to cultivate trust and solidify its position within the Ethereum ecosystem.

2. User Adoption: Ethereum has a larger and more mature DeFi user base compared to Solana. Liquid staking tokens (LSTs) like Lido's stETH are readily integrated into many DeFi protocols, making them more attractive to users who want to earn additional yield on their staked tokens. Solana's DeFi ecosystem is still developing, and the integration of LSTs is not yet as widespread.

3. Risk Perception: Some users perceive liquid staking as introducing additional risks compared to traditional staking. The smart contracts involved in liquid staking can be vulnerable to hacks or exploits, and the price of LSTs can fluctuate due to market conditions. These concerns may be amplified for newer users or those unfamiliar with DeFi concepts.

The same issue was pointed out by Lucas Bruder, CEO of Jito Labs. In the interview with Dlnews Lucas said: “There’s a huge opportunity to unlock the other 97% of stake on the network for liquid staking. I don’t think any LST protocol has been able to figure out the correct marketing and narrative for that yet, we’re excited to take a swing at it and figure it out.”

Also, one interesting insight is that among all the validator nodes that have staked more than or equal to 5000 sol tokens in the last 6 months only 101 hold LSTs, And when we talk about the percentage of Sol tokens via Liquid staking by these Validator nodes, it even becomes worse because it stands at 0.3%.

Stating the same issue Solana Co-founder Stated this on Twitter:

SolBlaze

For a while, Marinade and Jito held a strong grip on the Solana Liquid Staking market. However, there's a fresh contender that's been gaining significant traction lately. Sol Blaze has swiftly emerged as a prominent player in the industry, capturing over 15% of the market share. Its rapid rise is drawing attention and interest from users at a remarkable pace.

One factor contributing to this expansion is the rising value of the Sol token, along with heightened investments in liquid staking derivatives. Additionally, the introduction of innovative protocols such as BlazeStake and Blazerewards by Solblaze has played a significant role in fueling this growth.

We will look deep into Solblaze in this section.

What is BlazeStake?

BlazeStake represents a completely non-custodial protocol for Solana stake pooling, backed by the Solana Foundation. When users stake their $SOL through BlazeStake, they receive BlazeStake Staked SOL (bSOL) tokens, which they can utilize within various DeFi applications. BlazeStake autonomously delegates $SOL across multiple Solana validators, thereby enhancing the decentralization of Solana. This arrangement benefits both validators and $SOL providers by rewarding them accordingly.

blaze staked sol

$bSOL is crafted to appreciate in value in each epoch relative to $SOL, aligning with the staking APY. This is because $bSOL is continually backed by a growing amount of $SOL through compounding staking rewards. Users have the flexibility to withdraw their $SOL from the stake pool whenever they wish, either instantly or through delayed unstaking.

Bsol vs Sol

As we can see Bsol ( in yellow line) has accurately followed SOL price (in the bule line) and maintained its peg, even after a couple of high-stress events.

Blaze

The BLZE token functions as the native utility token for SolBlaze, a leading decentralized finance (DeFi) platform operating within the Solana ecosystem. It serves as the main means of exchange and governance tool, empowering users to engage in a range of activities including staking, yield farming, and participating in voting for platform proposals. As its adoption expands and innovative protocols emerge, the BLZE token stands at the forefront of shaping the future landscape of DeFi on Solana.

Tokenomics

BLZE token numbers

Total Supply: 10B

- 30% initial airdrop (accumulates from now until midnight ET)

- 70% ongoing rewards

BLZE token Distribution Mechanism

- 75% will be distributed proportionally by SolBlaze Score

- 10% will go to SolBlaze (1% unvested 9% vested)

- 5% will be used to bootstrap initial BLZE liquidity

- 5% will go to a newly created SolBlaze DAO

- 5% will go towards expansion of SolBlaze

- 60% will be distributed proportionally by SolBlaze Score

- 20% will go to BLZE-controlled DeFi gauges

- 5% will go to SolBlaze-controlled DeFi gauges

- 5% will go to SolBlaze

- 5% will go to SolBlaze DAO

- 5% will go towards expansion of SolBlaze

BLZE Token emission

Ongoing rewards begin at a rate of 145,833,333.333333333 BLZE per week (as of Aug,2023) and are cut in half every 24 weeks (approximately 6 months). That means that over time, less and less BLZE will be distributed through emissions.

BLZE Token Utility

BLZE is the governance token of SolBlaze, empowering holders to influence DAO proposals, BlazeStake distribution, DeFi emissions, and more.

10% of the BlazeStake delegation pool will be governed by BLZE gauges. Each BLZE locked in governance enables voting for additional stake delegation to preferred validators.

Moreover, 20% of ongoing BLZE rewards will fuel DeFi emissions via BLZE gauge-based voting. Initially, this covers bSOL-based LP pairs and lending integrations, with plans to expand to all DeFi pools, fostering Solana's DeFi ecosystem growth.

Additionally, 20% of stake pool revenues will be allocated to buying and burning BLZE from the market, potentially making BLZE deflationary. Another 20% will enhance BLZE liquidity, and 10% will fund the SolBlaze DAO.

BlazeRewards incentivizes liquid staking and DeFi engagement on Solana, while the SolBlaze Score rewards participants and grants governance influence.

BLZE rewards

What is the SolBlaze Score?

Your SolBlaze Score tracks your individual impact within the SolBlaze ecosystem, reflecting your ongoing contributions. Keep your score high by staking with BlazeStake!

How is the SolBlaze Score calculated for users?

If you have 1 bSOL in your wallet, you'll earn a score of +1.

If you hold 1 bSOL in supported lending protocols, you'll get a score of +1.5.

Having 1 bSOL (or its equivalent) in supported bSOL LP positions will give you a score of +2.

Whenever you refer a user to SolBlaze, you'll receive 10% of their score added to your own!

Validators and DeFi protocols also possess a SolBlaze Score.

Holding 1 bSOL (or equivalent) in a DeFi protocol earns you a score of +1.

Allocating 1 SOL of Custom Liquid Stake to your validator results in a score of +1.

The SolBlaze Score for a validator is directly linked to the validator's identity key.

Your SolBlaze Score plays a crucial role in determining your portion of BLZE token rewards. The higher your SolBlaze Score, the greater your share of rewards you'll receive! The aim is to boost your SolBlaze Score by engaging in BlazeStake liquid staking and DeFi activities to earn more BLZE tokens.

Details on user-controlled delegation systems

SolBlaze promotes user control in its delegation system through Custom Liquid Staking, enabling users to select specific validators to delegate their stake to. Additionally, SolBlaze Gauges empower delegators to allocate additional stakes to their preferred validators. The platform strives to strike a balance between rewarding validators, maintaining high scores, and supporting smaller validators to enhance network decentralization without compromising security.

All validators undergo automated monitoring and human review to address any issues promptly. As the stake pool Total Value Locked (TVL) grows, SolBlaze aims to diversify stake distribution among a broader range of validators, further enhancing decentralization.

Over time, the BlazeStake delegation strategy will decentralize as governance over the security group, comprising approximately 32 validators controlling over 33% of the stake, is dispersed. Mitigating the risk of collusion among these validators, SolBlaze spreads stake across a wider range of validators, reducing the potential impact of coordinated actions.

Delegation Strategy

How are validators chosen and included in the BlazeStake pool?

What is our goal for selecting validators?

The security group consists of approximately 32 validators who collectively control more than 33% of the staked SOL. While they are disincentivized from colluding, if they did, they wouldn't be able to create fake transactions but could prevent new transactions from being approved, as 2/3 stake consensus is needed. Since these validators are well-established and hold significant SOL stakes, we don't include them in our stake pool.

What is the long-term vision of the delegation strategy?

As BlazeStake's stake pool total value locked (TVL) increases, our goal is to boost decentralization on the Solana network by diversifying stakes across more validators. We plan to launch initiatives to support new validators with temporary extra stakes and reward existing validators for their unique contributions to decentralization. Our delegation strategy will shift towards greater decentralization, with BLZE holders voting on governance and distribution through gauge-based mechanisms.

What is the security group?

The security group consists of approximately 32 validators who collectively control over 33% of the staked SOL. Although collusion among them is highly discouraged, if it were to occur, they could potentially halt the approval of new transactions by withholding their agreement, as new transactions require at least 2/3 stake approval. Due to their established status and significant SOL stake, we opt not to include them in our stake pool.

What is the stake coefficient and base stake amount?

In BlazeStake pool, validators are assigned a stake coefficient determined by factors like APY, performance, and their contribution to network decentralization. The base stake amount adjusts dynamically based on the total staked SOL and the sum of stake coefficients. Validator SOL amounts are calculated using a straightforward function.

The amount of SOL staked to each validator is determined using the following simple function:

In this scenario, "s" denotes the staked amount, "v" represents the validator, "b" is the function used to calculate the base stake amount, which depends on the total staked amount "t" and the sum of stake coefficients "s", and "c" is the function that determines the stake coefficient for each validator.

The base stake amount is determined using another simple function:

99.8% of the total staked SOL is used in this calculation, since the other 0.2% is held in the stake pool reserves and is used for instant (liquid) unstaking.

How is the stake coefficient calculated for high-rewarding validators?

The top 50 validators with the highest APY according to stakeview.app are included in the stake pool with the following guidelines:

If the validator is in the top 20 by APY, their stake coefficient increases by 1000.

If the validator is in the top 21-25, their stake coefficient increases by 900.

If the validator is in the top 26-30, their stake coefficient increases by 800.

If the validator is in the top 31-35, their stake coefficient increases by 700.

If the validator is in the top 36-50, their stake coefficient increases by 600.

If the validator is in the top 51-75, their stake coefficient increases by 500.

If the validator is in the top 76-100, their stake coefficient increases by 250.

How is the stake coefficient calculated for high-scoring validators?

Validators ranked in the top 50 on validators.app and not in the security group receive a stake coefficient boost of 150, with an extra 25 if they rank in the top 25. Similarly, validators in the top 50 on stakewiz.com receive a 150-coefficient boost, plus 25 for the top 25. If a validator ranks in the top 50 on both platforms and isn't in the security group, they receive an additional 50-coefficient boost on top of any previous increases.

How is the stake coefficient calculated for smaller validators?

If the validator does not satisfy any of the previous guidelines and is outside the security group, their stake coefficient increases by 130, provided they follow all of the following rules:

The skipped slot rate must be less than 10%.

The voting success rate must be at least 80%.

The commission must be no greater than 6%.

If the validator does not satisfy the above guidelines but does satisfy the following guidelines, their stake coefficient increases by 125 instead:

1. The skipped slot rate must be less than 20%.

The voting success rate must be at least 70%.

The commission must be no greater than 8%.

If the validator does not satisfy the above guidelines but does satisfy the following guidelines, their stake coefficient increases by 120 instead:

The skipped slot rate must be less than 30%.

The voting success rate must be at least 60%.

The commission must be no greater than 10%.

If the validator does not satisfy the above guidelines, their stake coefficient increases by 115 instead, provided that the validator is not delinquent and has a commission of no more than 10%.

Is there any human component to the review process?

Stake distribution calculations are automated, but if validators are flagged for suspicious behavior, a human reviews them for potential removal from the pool. Additionally, human verification is conducted before applying stake changes to the pool to catch any bugs in the automated program that could lead to abnormal stake distribution.

Can stakers decide validators?

Certainly! With Custom Liquid Staking, users have the option to delegate their stake to chosen validators. SolBlaze Gauges enable delegators to use BLZE to allocate additional stakes to their preferred validators.

Custom Liquid Staking

BlazeStake introduced the Custom Liquid Staking (CLS) protocol, allowing delegators to have full control over their delegation decisions. It enables staking liquid assets directly to specific validators on the Solana network. With CLS, your stake is recorded upon staking, with an equivalent amount of bSOL (BlazeStake's token) held in your wallet to maintain the 1:1 staking relationship.

If your bSOL balance drops below the minimum threshold, your stake to the chosen validator decreases proportionally. CLS supports staking to multiple validators, and if your bSOL balance falls below the threshold for all validators, stakes are adjusted accordingly. Additionally, CLS tracks your bSOL holdings across DeFi protocols to calculate your total control over bSOL in your wallet.

Custom Liquid Staking also supports custom delegation strategies, as seen with Lamport DAO. This feature allows for finer control over stake distribution by setting delegation weights, but it's currently in an invite-only beta phase. If interested, reach out to BlazeStake via email or Twitter to set up a custom delegation strategy.

Economic implications of liquid staking protocols for validator operators

The economic implications of liquid staking protocols for validator operators are multifaceted and can significantly impact the decentralization and security of the underlying blockchain network. Some of the key implications include:

High Economic Barrier for Individual Validators: Liquid staking protocols often require a significant amount of the native cryptocurrency to run a dedicated node, such as the 32 ETH economic requirement for Ethereum validators. This can be a barrier for individual validators, leading to a concentration of power among a small number of stakers who control a significant share of the blockchain.

Locked Funds and Lack of Liquidity: Staking funds become locked and lack liquidity, pushing stakers to join staking pools instead of operating as individual validators. Staking pools often prove more profitable than individual validators due to the advantages of safety mechanisms and insurance they offer.

Centralization and Cartelization Risks: The dominance of a single liquid staking protocol can lead to concerns about centralization and the potential for cartelization, which can erode the core decentralization principles of the blockchain network.

Impact on Network Security and Decentralization: The economic implications of liquid staking protocols can impact network security and decentralization, especially if a small number of stakers control a significant share of the blockchain, leading to potential risks such as transaction censorship and erosion of decentralization principles.

To address these implications, there have been calls for more decentralized and pocket-friendly solutions, such as community-driven liquid staking protocols that aim to reduce the barriers for individual validators and enhance network security and decentralization.

How do liquid staking protocols affect the demand for validator services

Liquid staking protocols can affect demand for validator services in multiple ways. They can boost demand by allowing users to earn rewards by staking tokens in PoS networks like Ethereum, Avalanche, Polkadot, Cardano, and Cosmos. However, they can also decrease demand for individual validators by locking up staking funds, prompting stakers to join pools instead. Staking pools are often more profitable due to safety mechanisms and insurance. Additionally, reliance on a single protocol like Lido can raise concerns about centralization, potentially impacting demand for validator services. If a few stakers control a significant portion of the blockchain, it can risk transaction censorship and undermine decentralization.

SolBlaze V/S Marinade V/S Jito

Different ways to use liquid staked tokens in the DeFi ecosystem

Currently, there are 4 major use cases for LSTs in decentralized finance.

Collateral in DeFi: LSTs can be used as collateral in lending and borrowing protocols, enabling stakers to unlock liquidity from their staked assets without compromising their stake. This allows participants to access loans or engage in leverage trading strategies while maintaining their position in the staking ecosystem.

Trading and Exchange: LSTs can be traded on decentralized exchanges (DEXs) or centralized exchanges, providing a liquid market for staked assets. This facilitates seamless trading and price discovery for users who wish to buy, sell, or swap staked assets without the need for lengthy unstaking processes.

Synthetic Assets and Derivatives: LSTs can serve as the basis for the creation of synthetic assets and derivatives, allowing users to gain exposure to staked assets without directly holding them. This opens up possibilities for creating innovative financial products and expanding the range of investment opportunities in the crypto ecosystem

Farming Airdrops: Blaze and its token One interesting strategy that has been used to farm BLZE in @marginfi and @Kamino_Finance involves using the bSOL as collateral to borrow SOL, staking that SOL for bSOL, and then depositing it back into the money market. This process can be repeated multiple times but becomes increasingly risky with each loop. The advantage of this strategy is that if the interest rate of SOL is lower than the combined staking rewards and BLZE airdrop rewards of the bSOL, the borrower can profit from the borrowed funds. However, the risk is that if the bSOL depegs against SOL, it could trigger a liquidation of the position and cause the borrower to lose their collateral. This occurred with mSOL in Q4 of 2023, leading to significant liquidations.

Airdrop strategies and rewards/incentives mechanisms with liquid staking.

Airdrops are one of the best marketing and rewards distribution strategies for a Crypto protocol, not only it create hype for the product in the market but also bring new users to the ecosystem.

Moreover, these airdrops are one of the best ways for users to get free money just for using the product or being an early part of the community. Therefore many people made airdrop farming their bread and butter.

Airdrops can range from a couple of dollars to maybe a 4 or 5-figure number. Whenever a product launches a token the protocol generally drops a token and rewards the early members. Like for example the Jito airdrop was really big in the Solana ecosystem.

But as the Defi is evolving, the team is also holding the airdrop allocation and doing multiple rounds of airdrops, and in the case of the LSTs, these airdrops are given during multiple campaigns. Like Blaze is given to Bsol to lenders, and borrowers and for providing liquidity in the vaults across the defi protocols like Kamino or marginfi.

Liquid stake with Solblaze Portal

Stake: With the stake function, you can liquid-stake your sol (with a blazestake Validator or a custom Validator of your choice) and get bsol in return which you can use across Defi.

Steps to stake your SOL with Solblaze Validator

Go to Stake.solblaze.com or click on stake option from the solblaze homepage

Click on the Stake Now button and you will get to the following page

Connect your wallet.

Select the amount of sol you wanna stake( for instance, i have selected 0.1 sol)

Click on stake and sign the transaction

Solana has been liquid staked with Solblaze and I have successfully received bSOL in my Wallet.

Dashboard

You can see all the stats in the dashboard about the Blaze and bSOL ecosystem across the Defi ecosystem.

How to use LST in the DeFi.

Lending and Borrowing:

The LST can be used for Lending and Borrowing in protocols like Kamino, marginfi and many more. With lending, a user can earn additional yield and exclusive rewards from the LST protocols as well.

Some of the Lending and Borrowing protocols are Kamino, Marginfi, Drift, and many more

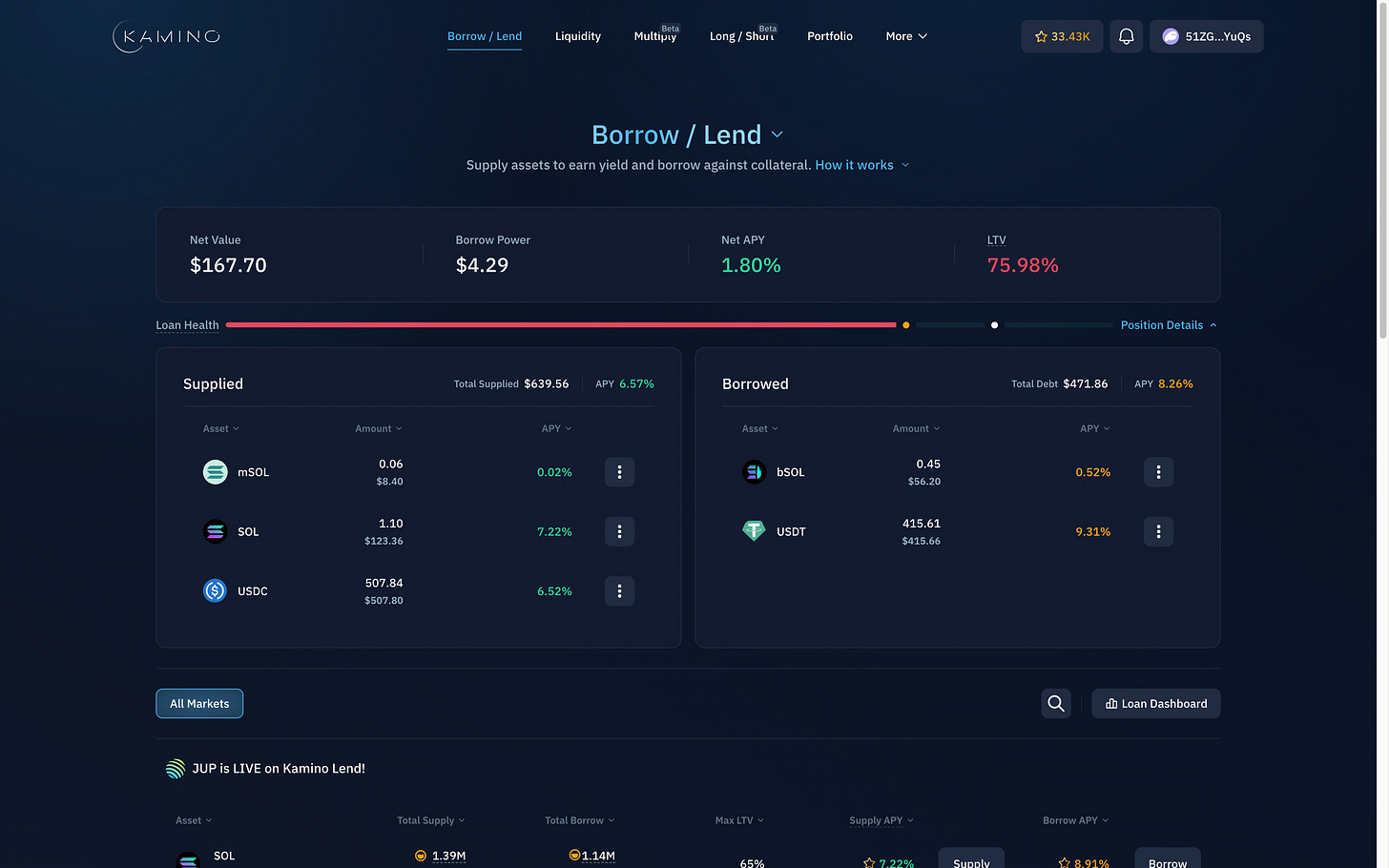

Steps for lending and borrowing.Here I am using an example of Kamino Finance, Although the steps in other protocols are almost the same.

a. Go to Kamino Finance.b. Connect you wallet by clicking on the ‘Connect Wallet’ button.

c. Once the wallet is connected click on the “Supply” button.

d. Select the amount you wanna lend. ( i am lending 0.8 bsol)

e. Click on deposit, and done.

You have now supplied your bsol to Kamino finance. Now you can borrow another assets by using your bsol as a collateral.

Providing Liquidity

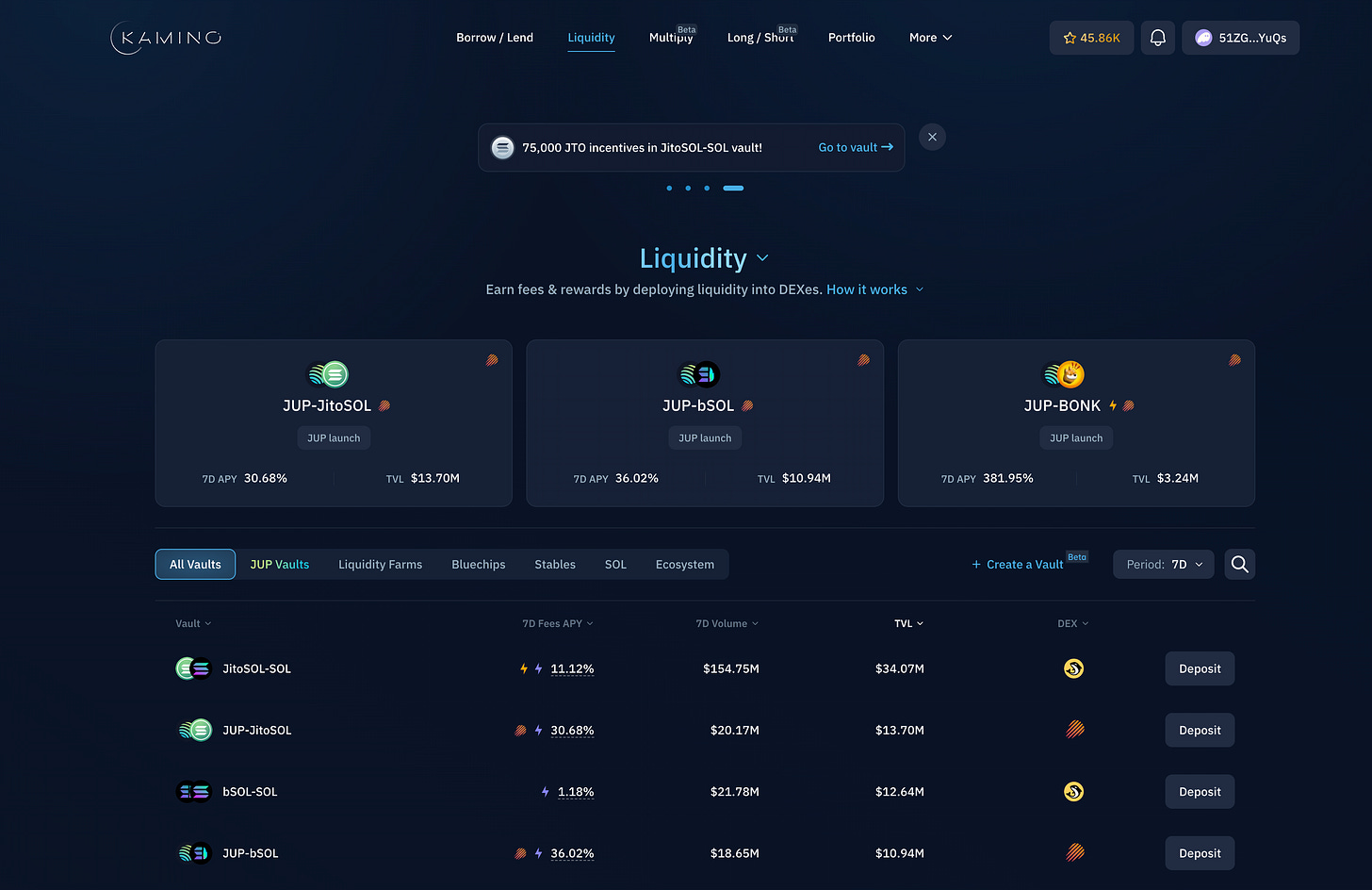

You can also provide liquidity to different pools in via different protocols and get both Strategy yields and incentives as well. In case of bsol you get BLZE token rewards, depending on certain criteria.

Step by Step procedure for providing liquidity

a. Open Kamino app and click on “Liquidity Section”

b. Choose a pair of your choice that have bSOL. I have chosen JUP-bSOL liquidity pool.

c. Select the amount of bSOL you wanna deposit in the pool. i have deposited 0.08 bSOL in the single asset deposit.

(To be noted that Liquidity pool always require 2 assets, in the case of single asset deposit, your collateral will be converted in the background by the protocol as per the required ratio)

d. Click on deposit and Stake. (Suggestion: Read the documentation and before submitting. You can lose your assets )

e. Sign the transaction.

f. Wait for the transaction to confirm. once done you can see you assets on Dashboard.

Defi

Solbalze Defi Ecosystem: Bsol can be used across the Defi in the Solana Ecosystem and earn the Blaze rewards.

Some protocols are as follows:

Solend

Orca

Kamino

Drift

Hawksight

Mango markets

Raydium

Meteora

Crema

Marginfi

Jupiter

Prysm

Conclusion

The liquid staking ecosystem on Solana has witnessed remarkable growth, with protocols like Marinade, Jito, SolBlaze, and Marginfi playing a significant role. These protocols have seen a substantial increase in staked SOL tokens, marking a 2000% surge since the beginning of 2023. Despite this growth, only about 5% of staked SOL tokens on Solana utilize liquid staking, a much lower percentage compared to Ethereum's 45%. Reasons for this lower adoption include the relative immaturity of the ecosystem, limited user adoption, and perceived risks associated with liquid staking. However, innovative protocols like SolBlaze are rapidly gaining traction in the market, offering unique features like BlazeStake and BLZE token utility that are shaping the future of DeFi on Solana. As the liquid staking landscape evolves, these protocols are poised to drive further innovation and participation in the Solana ecosystem.

References

https://members.delphidigital.io/reports/the-race-to-become-solanas-liquid-staking-winner

https://solanacompass.com/staking/liquid-staking.

https://phantom.app/learn/crypto-101/solana-liquid-staking

https://bullperks.com/liquid-staking-and-its-benefits-a-deep-dive/.

https://www.stakingrewards.com/journal/research/a-guide-to-solana-liquid-staking

https://x.com/jackthepine/status/1701636723351118312?s=20.

https://x.com/SolanaFndn/status/1435664744975798282?s=20