Index

Reward Mechanism for Validators and Developers

Validators

Developers

Solana transactions

Transaction structure

Transaction execution

Transaction confirmation

Solana fees

Fees structure in Solana

Economic Efficiency

Compatibility of Rewards & incentives

Local Fees markets

Solana Tokenomics

Sol Token numbers

Sol Token Distribution

Sol Token unlocks

Token Utility

Sol Token Inflation design

Sol token demand drivers

Sol token value capture

Business Model

Market Analysis of Solana

Solana vs L1s : A comparison

Developer sentiments

Ecosystem Impact

Defi

NFTs

DePin

Meme coins

Future Economic Project of Solana: Predictions and Analysis

Predictions on Solana's Future Economic Performance

Impact of Collaboration and Innovation

References

Tokenized ecosystems, like public blockchains, are all about getting people to do the right things. Just like how AI faces challenges, these ecosystems rely on incentives to keep things running smoothly. Blockchains are special because they're not controlled by one person, transactions are permanent, and they make it easy to create and move assets. This makes blockchains like "trust machines" that can do cool stuff like smart contracts.

One cool thing about blockchains is that they make sure everyone who owns tokens cares about the network doing well. By giving out tokens as rewards, blockchains can encourage people to act in certain ways, turning them into "incentive machines." Designing these incentives is like having a superpower in the blockchain world because it shapes how people in the network behave based on the rewards they get.

Creating good incentives isn't just about deciding what you want people to do; it's also about making sure the machines understand what you want. This means having clear rules and ways for incentives to work in blockchain systems. It's a tricky job that needs a deep understanding of economics, social dynamics, and technology to get it right.

In the end, how incentives are set up in tokenized ecosystems really affects how people act. By using block rewards and Tokenomics, blockchain networks can encourage users to be positive contributors. But making sure these incentives are well thought out and clearly explained is a big challenge that the blockchain community is always working on improving.

Reward Mechanism for Validators and Developers

Solana has carefully crafted its Tokenomics and various programs to ensure that Validators and developers are fairly incentivized. These key players are motivated to contribute to the network's growth and success.

Validators

Staking rewards: Validators on Solana earn rewards for taking part in the network's Proof of Stake system. These rewards come from staking activities that happen in defined time periods called epochs. During these epochs, validators get the chance to create blocks and earn rewards based on how well they perform.

Commission: Validators earn extra income by charging a commission on the rewards they receive from the stakes they hold. These commissions, which can range from 0 to 10%, provide validators with additional revenue based on their stake and performance. This setup allows validators to earn more than their delegators through commissions, giving them a financial incentive to run a validator.

Developers

Transaction Fees: Developers on Solana get a share of the fees when users use the apps they create. This encourages developers to make efficient and valuable apps that attract users, helping the ecosystem grow.

Grants and Programs: The Solana Foundation and various ecosystem initiatives provide grants and programs to support developers working on the platform. These financial incentives aim to attract talent, spark innovation, and offer resources for developers to improve their projects.

Token-based incentives: In some projects, developers are rewarded with the platform's own tokens for creating on the platform. By connecting developers' interests with the success of the project through token rewards, projects motivate developers to actively participate and contribute.

Solana Transactions

Transaction structure

A Solana transaction comprises three main components:

Instructions: Specify the on-chain code to be executed, such as transferring assets between accounts.

Accounts: Represent discrete pieces of state required by the transaction, with read and write permissions.

Signatures: Required for transaction authorization, ensuring security and authenticity

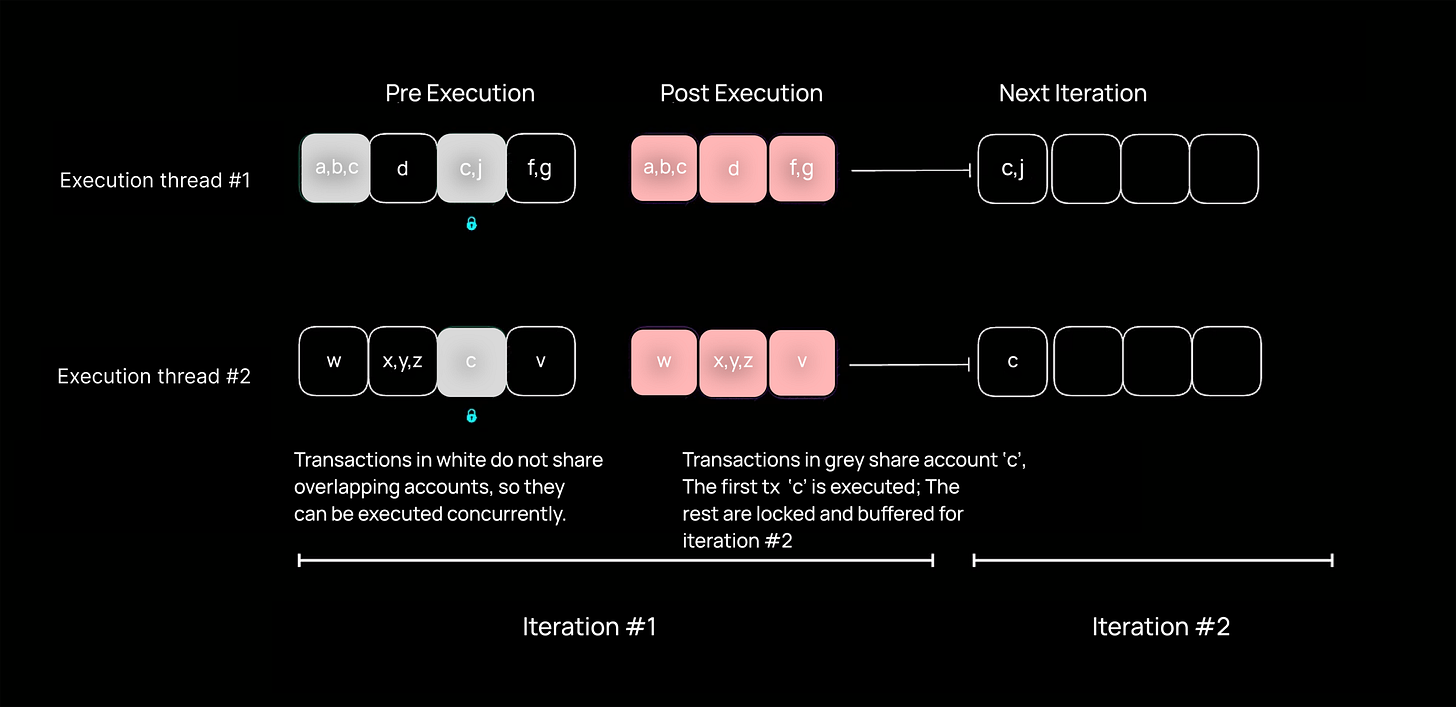

Transaction execution

Solana's runtime processes transactions in a unique manner compared to Ethereum, with a focus on parallel execution and ordering.

Transactions are directly forwarded to the current leader and subsequent leaders, bypassing the need for a public mempool like Ethereum.

Solana's multi-threaded scheduler enables parallel transaction processing, enhancing system throughput but also introducing scheduler jitter that may incentivize spam transactions.

Transaction confirmation

Solana clusters require transactions to use block hashes that are not more than 151 slots old to ensure timely processing.

Validators track processed transaction IDs to prevent double processing and manage transaction expiration effectively.

The network's design allows for quick confirmation or rejection of transactions, minimizing pending states and ensuring efficient transaction processing.

Solana Fees

Fee structure in Solana

In Solana, the fees for transactions are calculated using a fixed base fee per signature and an optional priority fee specified in the transaction. The base fee is set at 5000 lamports (0.000005 SOL) per signature, while the priority fee is denominated in microlamports per compute unit (CU) requested. The total fee for a transaction is the sum of the base fee and the product of the number of CUs requested and the specified priority fee per CU.

For example, let's say we have a transaction that requests 800,000 CUs with a priority fee of 3000 microlamports per CU. If this transaction has one signature, the total fee calculation would be as follows:

Base Fee: 5000 lamports

Priority Fee: 800,000 CUs * 3000 microlamports/CU = 2,400,000 microlamports = 2400 lamports

Total Fee: Base Fee + Priority Fee = 5000 lamports + 2400 lamports = 7400 lamports or 0.0000074 SOL.

Therefore, for this example transaction with altered numbers, the total fee would amount to 7400 lamports or 0.0000074 SOL.

Economic Efficiency

Solana encourages efficiency through its fee model by allowing users to adjust priority fees based on the computational resources their transactions need. Transactions with higher priority fees per Compute Unit (CU) get included in blocks first, motivating users to optimize their transactions for efficiency. This approach pushes users to streamline their transaction execution, cutting down on resource use and boosting overall network performance.

In simpler terms, Solana's way of working is like giving a fast pass to transactions that pay more for quicker processing. By letting users decide how much they want to pay for priority, Solana nudges them to make their transactions run smoother and use fewer resources. This not only helps the network run better but also encourages users to be more efficient in how they interact with Solana.

Compatibility of rewards & incentives

In Solana, the fee system is set up to encourage users to support the network's goals. By letting users adjust their fees based on demand and resource usage, Solana ensures that users are motivated to contribute positively to the network's efficiency and scalability. This alignment between user incentives and network objectives creates a sustainable ecosystem where efficient transactions are prioritized and appropriately rewarded.

Local fee markets

Solana has come up with a clever solution to tackle the issue of high transaction fees during peak demand by introducing a local fee market. This innovative model allows for different gas fees for various contracts, creating a fair and efficient fee system. By containing fee spikes to specific programs, Solana ensures that users enjoy reasonable fees without disrupting the entire network. The concept of a local fee market aims to improve fee predictability, fairness, and efficiency, offering users smooth transactions while maintaining a balanced fee ecosystem.

Solana Tokenomics

Sol Token Numbers

Maximum Supply: Infinite (There is no maximum limit for the supply of SOL tokens)

Current Total Supply (Total Supply = Initial Max supply - burned tokens): 570,209,714

Circulating Supply: 440,962,849

New SOL tokens are created based on an inflation rate that varies each epoch

The proposed inflation rate is 8%, decreasing 15% annually until reaching 1.5%

Sol Token distribution

15.86% is allocated to Seed Sale

12.63% is allocated to Founding Sale

5.07% is allocated to Validator Sale

1.84% is allocated to Strategic Sale

1.60% is allocated to Public Auction Sale

12.50% is allocated to Team

12.50% is allocated to Foundation

38.00% is allocated to the Community Reserve

Sol Token Unlocks

Token Utility

SOL is Solana’s native token — community tokens are held by the Solana Foundation, which is run by an independent board. Community tokens are allocated to validator nodes for rewards. SOL serves several core functions on the network.

Staking: SOL token holders can stake SOL to validators operating on the Solana Network.

Exchanging: SOL token holders can trade SOL for running an on-chain program.

Governance: SOL token holders decide to stake and can participate in on-chain governance.

Fees: Validators incur costs by running and maintaining their systems. These costs are passed onto delegators.

Sol Token Inflation design

As mentioned above, the network's Inflation Schedule is uniquely described by three parameters: Initial Inflation Rate, Disinflation Rate and Long-term Inflation Rate. When considering these numbers, there are many factors to take into account:

In the world of tokenized ecosystems, like public blockchains, a significant amount of SOL coins are created through inflation and then given to stakeholders based on the amount of SOL they have staked. The goal is to make sure that the design of the Inflation Schedule leads to fair Staking Yields for token holders who delegate their SOL and for those providing validation services (earning commissions from Staking Yields).

The main driver of Staked Yield comes from the ratio of SOL staked to the total SOL available (% of total SOL staked). Therefore, understanding how tokens are distributed and delegated among validators is crucial when setting initial inflation parameters.

Research is currently focusing on yield throttling, which could affect staking yields. However, this aspect has not been addressed in the discussion here or the modeling provided below.

Considering long-term, steady-state inflation is crucial not just for supporting the validator ecosystem and grant programs of the Solana Foundation sustainably but also for balancing expected token losses and burning over time. It's important to keep in mind that inflation needs to be adjusted in line with these factors to ensure the ecosystem remains healthy and stable in the long run.

The rate at which we expect network usage to grow, as a consideration to the disinflationary rate. Over time, we plan for inflation to drop and expect that usage will grow.

Based on these considerations and the community discussions following the initial design, the Solana Foundation proposes the following Inflation Schedule parameters:

Initial Inflation Rate: 8%

Disinflation Rate: -15%

Long-term Inflation Rate: 1.5%

When we talk about the proposed Inflation Schedule, we're essentially looking at how new tokens are introduced into the system over time. These parameters we discuss define this schedule. The graphs we see only reflect the impact of token issuance based on these parameters and don't consider other factors like fee burning or unexpected events that could affect the Total Supply. So, what you see here represents the maximum amount of SOL tokens that could be issued through inflation.

In the above graph we see the annual inflation rate percentage over time, given the inflation parameters proposed above.

Sol token demand drivers

Solana offers super-fast and very affordable transactions for things like payments, gaming, and social media. When Web2 startups transition to Web3, they prefer high-performance blockchains like Solana.

Sol token value capture

Solana rewards Stakers and validators by offering them incentives at a rate higher than the annual inflation rate. Currently, the SOL staking APY stands at 7.75%.

Business Model

Solana earns money from transaction fees and revenue sharing through Solana Pay integrations with other platforms. Recently, VISA announced its use of Solana to settle USDC, potentially boosting Solana's network revenue from transaction fees.

Market Analysis of Solana

The chart above illustrates the daily market cap of networks like BNB Chain, Solana, Polygon, Avalanche, Near Protocol, and Arbitrum. It's evident that Solana has made significant progress in terms of market size, starting from November. Currently, Solana boasts a market cap exceeding $45 billion, showing a remarkable improvement from lagging behind its main L2 competitor in March 2023.

When we delve into statistics, things get more intriguing, especially when we consider the total value locked on the chain. At the beginning of 2023, there was a dip due to the FTX crash. Currently, Solana boasts the highest TVL on the chain, slightly surpassing BSC and coming in second only to Ethereum among Smart contract chains.

Solana has seen a sudden surge in active users since November 2023, driven by multiple token airdrops, increasing DeFi activity, and the growing interest in meme coins like BONK & WEN. The number of active users has nearly quadrupled compared to October last year.

Solana vs L1s : A comparison

Solana has always been known for its performance and low fees. it can also be clearly seen from the above comparison.

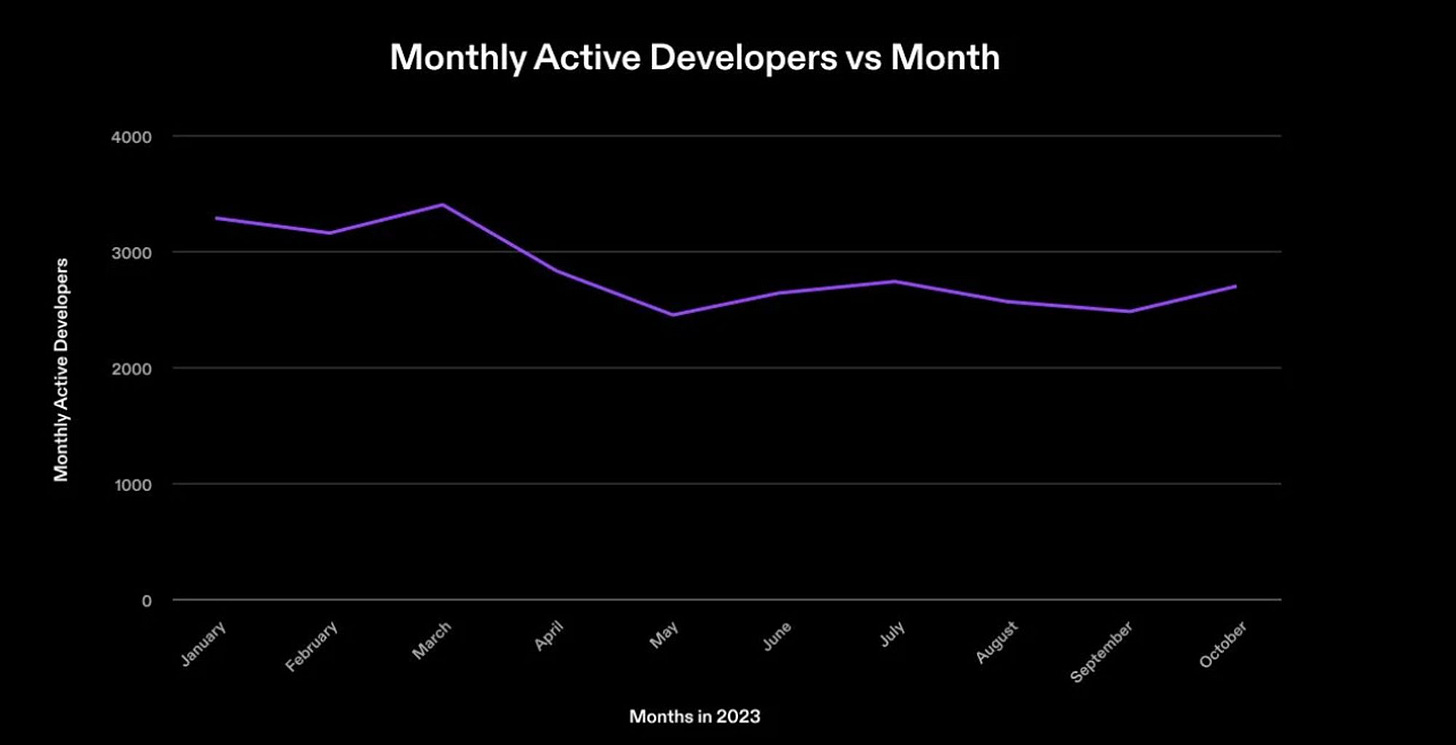

Developer sentiments

The Solana blockchain has garnered positive developer sentiments due to its growing ecosystem and developer-friendly tools. Despite being newer compared to Ethereum, Solana has seen significant adoption and support from developers. Here are key factors contributing to the positive developer sentiments on Solana:

Developer ecosystem growth

The Solana ecosystem boasts approximately 3000 developers actively building on the platform, with expectations of this number increasing due to recent price rallies.

Developers find Solana appealing for its low-cost, high-speed transactions, offering a better user experience compared to traditional EVM chains.

Access to funding and grants within the ecosystem has incentivized developers to stay and build on Solana, with teams raising close to $600 million from hackathons.

SDKs and Frameworks

Solana provides a strong foundation of SDKs like Rust, Solidity, TS/JS, Python, Java, PHP, C++, C#, and GoLang, making it accessible for developers from various backgrounds.

The availability of UI frameworks like React and Next.js simplifies development processes for a large number of developers.

Local development environment

The Solana Tool Suite offers a comprehensive local development environment enabling developers to build, test, and deploy applications efficiently on their local machines.

This tool suite allows developers to run test validators, deploy smart contracts, and conduct tests seamlessly, enhancing the development experience on Solana.

Ecosystem Impact

Creating a sophisticated economic and political system is pointless without practical applications and usage. Fortunately, Solana has become a hub for some of the most popular Dapps in the entire ecosystem. These applications have fostered an ecosystem that is driving a thriving on-chain economy. Let's explore some of these applications and stories and see how they are benefiting the Solana network.

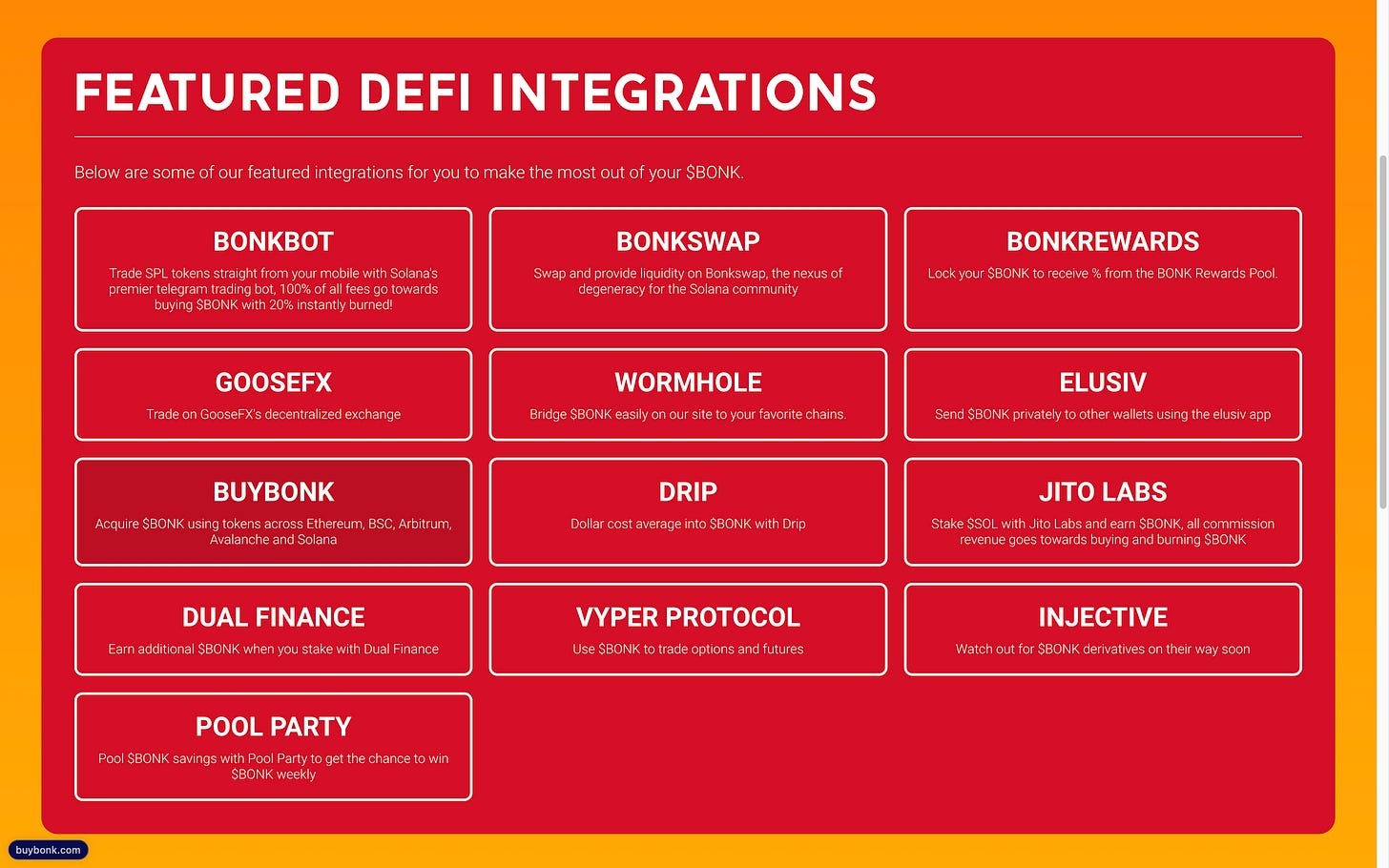

Defi

There has been talk about Defi on Solana lagging behind other ecosystems, with prominent figures like Solana's Co-founder Anatoly Yakovenko publicly acknowledging this in the past. However, the recent scenario tells a different story. In a recent event, Solana exceeded the daily trading volume of DEXs on Ethereum for a day. It consistently outperforms its L2 competitors like Polygon and Arbitrum, as well as L1 chains like Avalanche.

The biggest liquid staking protocols on Solana, like Jito and Marinade, have a combined Total Value Locked (TVL) of nearly $2 billion, which is around a quarter of Solana's total TVL. This indicates a thriving DeFi ecosystem on Solana, offering new opportunities for stakers to easily earn rewards by delegating their stake through liquid staking and earning yields on their LST tokens.

Solana faced a significant crash after the FTX crash in 2023 but has now entered a period of resurgence with the arrival of Solana DeFi summer. Exciting numbers and events are unfolding daily on Solana, showcasing the platform's growth and potential.

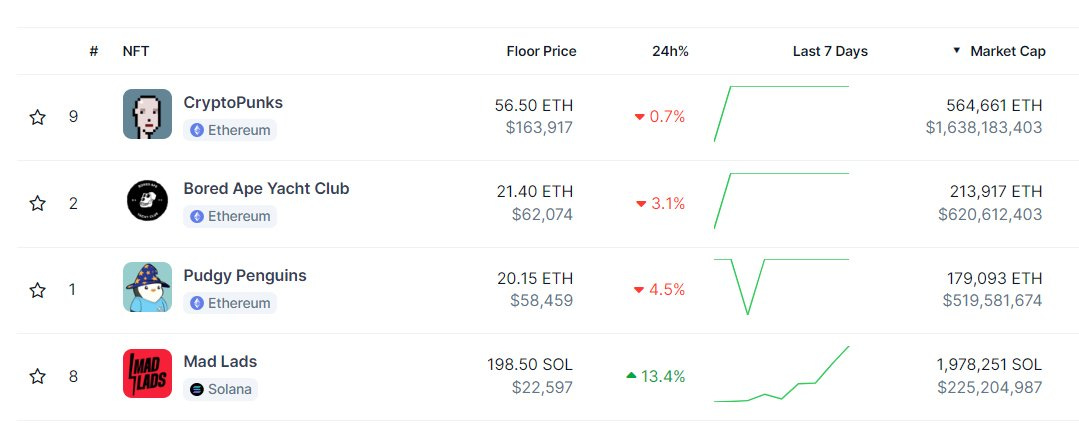

NFTs

NFTs have always been the superheroes of Solana, with protocols like Tensor and Megic-eden leading the way. On February 28th, Solana achieved over $10 million in NFT sales within just 24 hours.

Back in the day, people used to say that Solana would struggle if certain big players left, but guess what? The Madlads on Solana now have the 4th biggest NFT collection across all chains based on market cap. It's amazing how things can turn around!

Additionally, Tensor, the largest NFT marketplace on Solana, has outperformed Opensea, one of the major NFT platforms, in terms of trading volume for seven consecutive days.

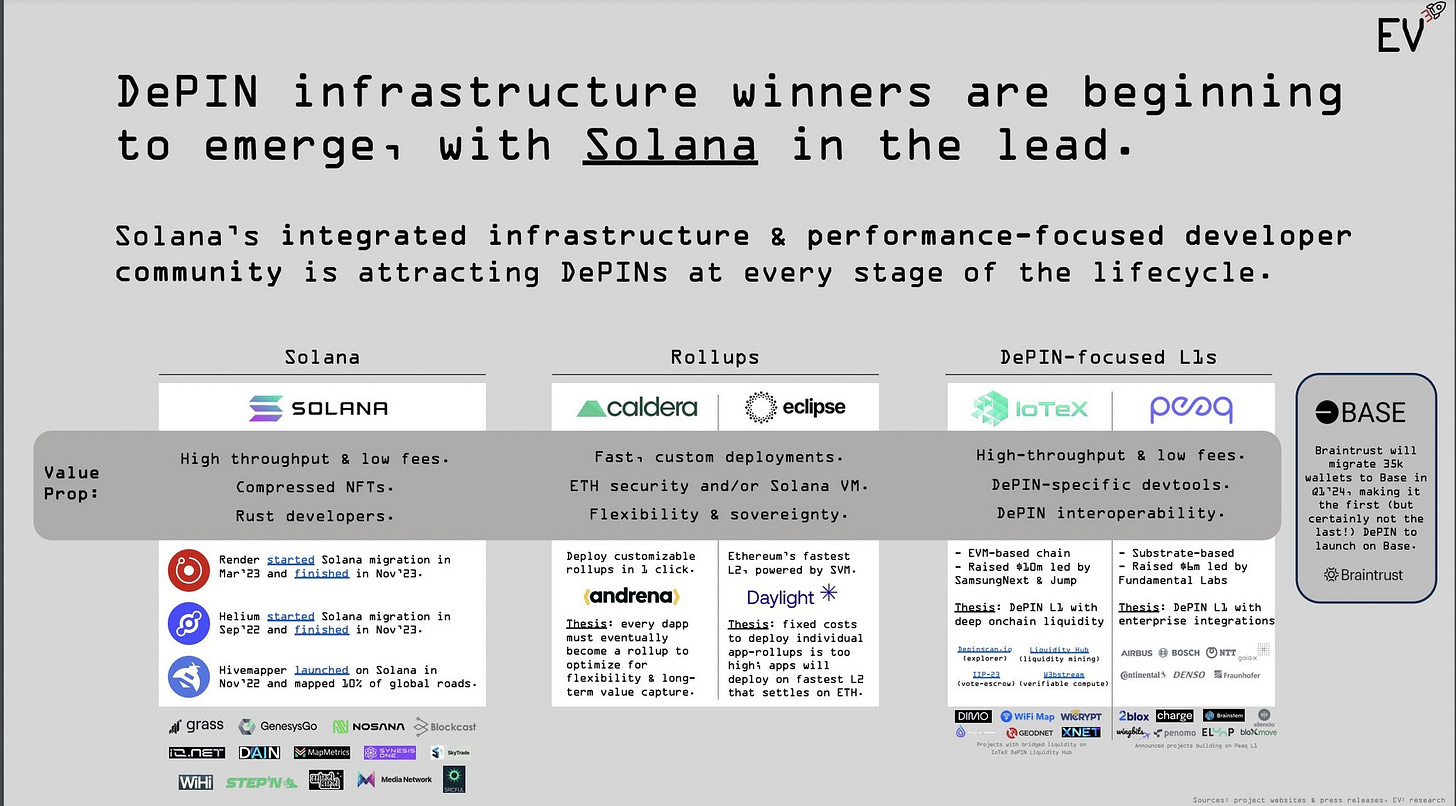

DePin

According to Messari.io, Solana stands out as a top player in the DePin landscape, not just a leader but the ultimate winner. Projects like Helium, Hivemapper, and Render exemplify the innovative applications of Solana in DePin projects, showcasing real-world uses and the immense potential of blockchain technology in managing physical infrastructure.

Hivemapper: Hivemapper operates as a decentralized mapping network that utilizes AI to generate maps based on regular travels, improving location verification through collaboration with Helium's network.

Helium: Helium operates a blockchain-powered wireless network that links IoT devices worldwide via hotspots. They are partnering with Hivemapper to enhance the accuracy and reliability of geolocation services.

Memecoins

Memecoins stand out as fantastic community-driven projects in the ecosystem. A successful memecoin reflects a thriving ecosystem, rich culture, and trust.

Recently, Solana has witnessed the rise of some incredible meme coins like BONK, WIF, and WEN. Notably, BONK has been integrated by approximately 120 protocols within the Solana ecosystem.

Meme coins aren't just about culture and fun; they can bring real value to the chain. For instance, when BONK experienced a price surge in December last year, the overall chain transactions and fees also saw a significant increase. This demonstrates how a successful meme coin can positively impact the chain by driving up activity and value.

Future Economic Project of Solana: Predictions and Analysis

Solana's future economic performance is a topic of interest, with experts and analysts providing insights into potential growth areas, emerging sectors within the Solana ecosystem, and external factors that could impact its economy.

Predictions on Solana's Future Economic Performance

Growth Areas: Experts foresee growth in Solana being driven by breakthrough applications native to the platform, such as the NFT placement platform DRiP and decentralized solutions. This indicates a positive trajectory for Solana's economic development.

Emerging Sectors: The future outlook for Solana presents promise alongside potential hurdles, with its ability to captivate the market being a bullish case for its economic performance. The platform's demonstrated scalability and efficiency position it well for growth in emerging sectors within the Solana ecosystem.

External Factors: Regulatory changes and market dynamics can significantly impact Solana's economy. While the cryptocurrency market is volatile, Solana's resilience during market fluctuations compared to other giants like Bitcoin and Ethereum suggests a level of stability. However, factors like regulatory shifts can influence its economic trajectory.

Impact of Collaboration and Innovation

Helium Collaboration: Collaborations with projects like Helium enhance Solana's capabilities in areas such as geolocation accuracy and reliability within decentralized mapping networks.

Potential in the payments market: Despite price fluctuations, Solana shows potential in the payments market, offering low fees and instant settlement times. Innovations like Solana Pay aim to disrupt traditional payment methods by providing faster transaction speeds and lower costs.

References

https://docs.solana.com/

https://blog.oceanprotocol.com/can-blockchains-go-rogue-5134300ce790?gi=044b07f4ee22

https://www.umbraresearch.xyz/writings/solana-fees-part-1

https://www.umbraresearch.xyz/writings/lifecycle-of-a-solana-transaction

https://www.coingecko.com/en/coins/solana

https://token.unlocks.app/solana

https://hmalviya9.notion.site/hmalviya9/9d183b864f5a408e80d3241b842cbd6c?v=b8f1ae631a234ed4b648acddd33e112f

https://www.electriccapital.com/resources

https://dune.com/home

https://app.artemis.xyz/overview

https://tokenterminal.com/terminal

https://defillama.com/